Kraken has agreed to acquire Backed Finance, a platform that issues blockchain-based tokens mirroring real-world securities such as individual stocks and exchange-traded funds. The exchange aims to pull these products closer to the core of its trading business as it prepares for a planned public listing in 2026.

Deal Details and Strategic Fit

Kraken already lists a range of tokenized stocks and ETFs that Backed issues, but the acquisition will allow the exchange to integrate issuance and trading under one roof.

???? We’re bringing @BackedFi, the company driving the issuance of xStocks, fully into Kraken.Why? Because tokenized equities won’t reach global scale without unified rails.With @xStocksFi now fully in-house, we’re accelerating the future of open, 24/7 capital markets ????…

— Kraken (@krakenfx) December 2, 2025

“Integrating Backed into Kraken strengthens the core architecture required for open and programmable capital markets. Unifying issuance, trading and settlement under one framework ensures the infrastructure for tokenized assets remains transparent, reliable and globally accessible,” commented Arjun Sethi, the Co-CEO of Kraken.

However, the companies did not disclose financial terms, but Kraken described the deal as part of a broader investment program around real-world asset tokenization. Backed Finance, founded in 2021, has quickly become a key player in tokenized public equities.

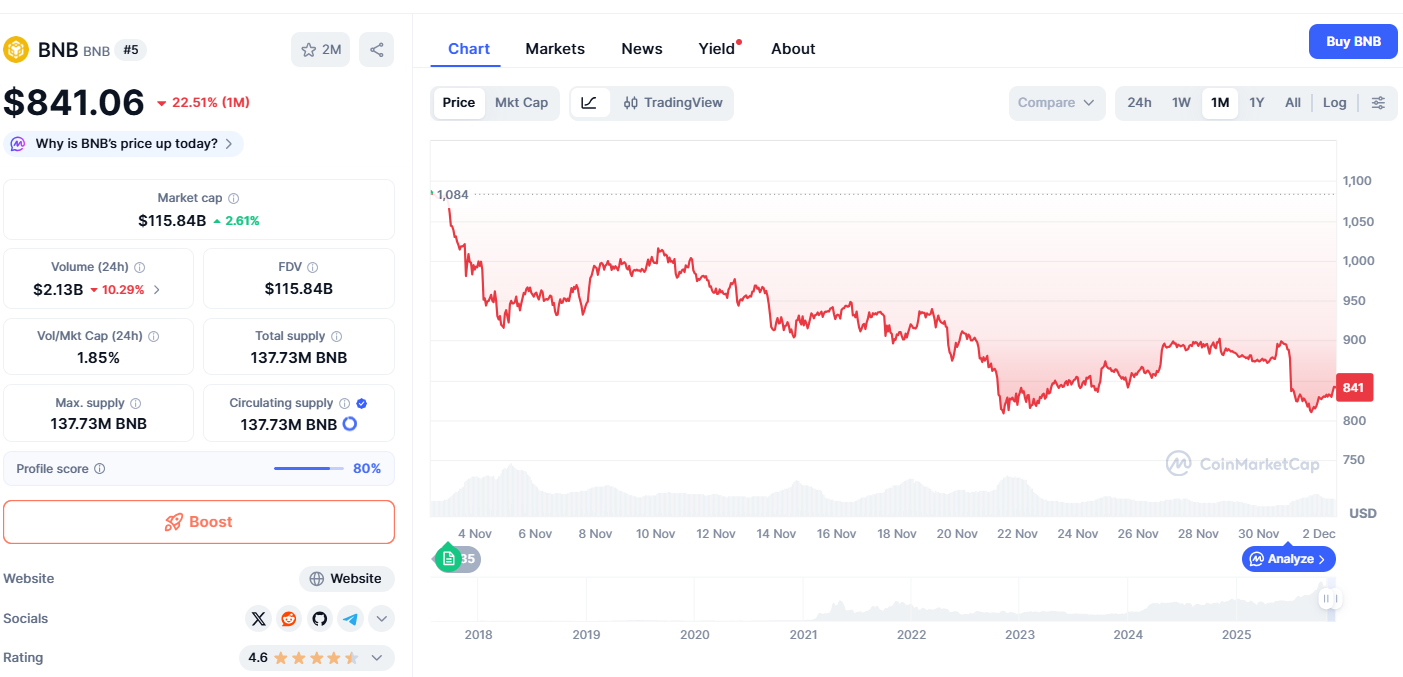

Earlier, Kraken collaborated with Trust Wallet to integrate its xStocks tokenized equities product into the self-custody wallet, enabling Trust Wallet users to purchase 60 different xStocks using various fiat currencies and to transfer these assets seamlessly across multiple blockchains, including Solana, BNB Chain, TRON, and Ethereum.

Wall Street’s growing interest in tokenization

Meanwhile, the tokenization of traditional financial instruments has drawn attention from large asset managers and centralized exchanges. According to Bloomberg, BlackRock has issued a tokenized money-market fund that holds more than 2.3 billion US dollars in assets, highlighting institutional willingness to experiment withblockchain rails for familiar products.

You may also find interesting: Prediction Markets Boom Draws CZ-Owned Trust Wallet, Joining MetaMask and Polymarket Integration

Several centralized trading venues have rolled out tokenized stock and ETF markets this year, pitching 24/7 trading access and the ability to use tokenized securities as collateral in other crypto-native transactions.

Despite the adoption of tokenization, Kraken is against the idea of private stock tokenization. Sethi recently distinguished the exchange's tokenized stock offerings from competitors that provide digital shares in private companies. He described Robinhood's approach to tokenizing private equity as fundamentally flawed and risky for investors, emphasizing the differences in their business models.

Sethi rejected the increasing popularity of outright tokenizing private company equity, noting that investors encounter significant challenges when attempting to exit such positions due to liquidity and resale restrictions.

This article was written by Jared Kirui at www.financemagnates.com.

You can get bonuses upto $100 FREE BONUS when you:

💰 Install these recommended apps:

💲 SocialGood - 100% Crypto Back on Everyday Shopping

💲 xPortal - The DeFi For The Next Billion

💲 CryptoTab Browser - Lightweight, fast, and ready to mine!

💰 Register on these recommended exchanges:

🟡 Binance🟡 Bitfinex🟡 Bitmart🟡 Bittrex🟡 Bitget

🟡 CoinEx🟡 Crypto.com🟡 Gate.io🟡 Huobi🟡 Kucoin.

Comments